Address

Unit 5, Newhouse Business Centre

Faygate

Faygate

Horsham

West Sussex

RH12 4RU

UK

About Halo Business Finance

Halo provides asset finance & banking facilities to all types of businesses from startups to established corporations, including private and public limited companies, sole traders, partnerships and private individuals.

Unlike many other finance providers, we act both as a principal lender and as a broker. This means that we can always secure the most competitive deal for you.

Our core values are openness and integrity. We work with you to source the best possible solution for your needs

- Immediate cash flow

- Over 95% approval rate

- Funds in your account within 24 hours

- Low interest rates

Products

Asset Finance

Asset finance is a type of finance that is used to obtain equipment for your business.

If your business is seeking to invest in tangible assets – be that office equipment, manufacturing equipment, cars or specialised vehicles – you would benefit from an affordable, secure means of finance.

Car Finance

Halo can arrange finance on your car – whether for business or personal use. We can also source vehicles if required.

Equipment Finance

You can have the equipment you need now, with payments spread across its useful life.

Since ‘soft’ assets often depreciate quickly it makes sense to use leasing to procure your computer, telephones, partitioning, copiers and other equipment.

Soft Play Finance

You can have the soft play equipment you need now, with payments spread across its useful life.

Since ‘soft’ assets often depreciate quickly it makes sense to use leasing to procure your soft play equipment.

Franchise Finance

Deciding to buy a franchise may be one of the most important financial decisions you’ll ever make. You’re not on your own – Halo’s experts are here to guide you through and show you how we can help.

Startup Finance

You can have the equipment you need to start your business now, with payments spread across its useful life. As well as finance for the assets you need, we can arrange unsecured loans, short-term loans and commercial mortgages for new start businesses.

Business Loans

Halo can arrange both unsecured and secured loans for almost any business purpose, with terms from 3 months to ten years.

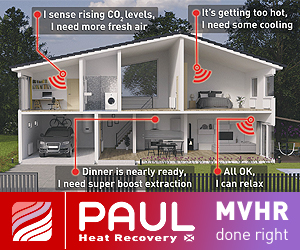

Renewables Finance

Halo are specialists in renewables finance. As we are independent from your other business banking facilities, any existing borrowing is uncompromised. Financing renewables equipment does not interfere with energy grants, so you can benefit from both

Cash Flow Finance

Invoice Finance is a great option to release cash flow tied up in invoices. Over 40,000 businesses across the UK use invoice finance and ~£14 billion is being injected into UK businesses via invoice finance solutions.

Mortgages & Bridging Loans

Halo are experts in finding you the best commercial mortgages on the market on terms and rates that suit your business.

Our panel of funders can lend up to 100% Loan To Value (LTV) on properties valued from £50,000 to £10 million.

Crowdfunding & P2P

Peer to peer (P2P) lending matches people looking to invest their money with people who want to borrow it. Compared to investing on the high street, lending via a P2P platform pays higher interest than a savings account and enables borrowers to borrow at lower rates than traditional bank finance.

Scotland

Scotland UK

UK Ireland

Ireland London

London