Address

152-160 City Road

London

EC1V 2NX

England UK

About NJB TAXBACK

Specialists in Tax Rebates for the Construction Industry

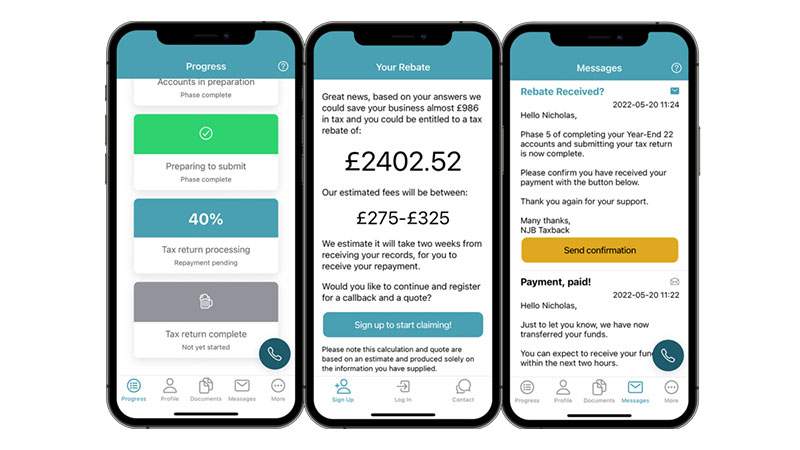

NJB TAXBACK offers a revolutionary one-stop solution to filing your self-assessment tax return that’s guaranteed against HMRC investigation.

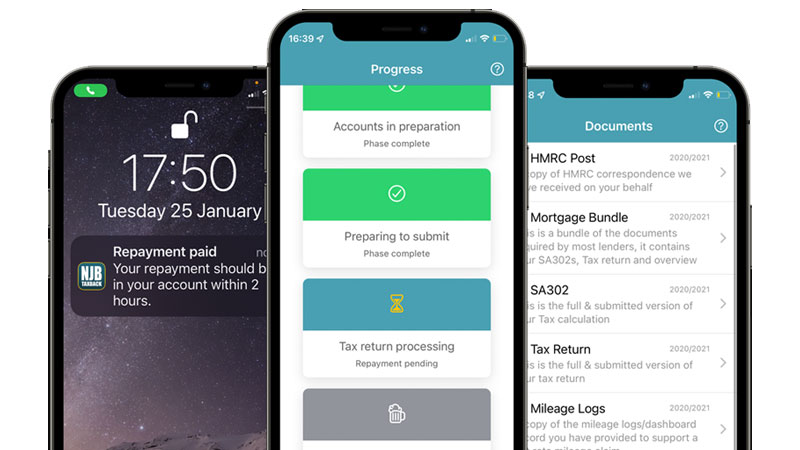

Our service combines the expertise of our qualified, friendly team with our free App to supercharge the process of completing your end-of-year tax return.

If you think you might be due a tax refund, download the NJB TAXBACK App and use our FREE rebate calculator to check.

A Simple Process

Get in touch

Download our free App and try our rebate calculator before signing up, or skip straight to signing up and book a call-back for a free consultation at your convenience.

Submit your information

We support bank statements, QuickBooks, emails or good old fashioned pen and paper. Whatever you prefer.

Sit back and relax

We aim to prepare all accounts for submission within 14 days. If you are due a refund, this will be paid directly into your bank account.

Our Services

Self-employed Startup

Includes Registering you as self-employed, applying for a UTR number, setting up a national insurance record, advising on a business bank account and optional accounting software.

Self-Assessment Tax Returns for Small Businesses

Sole Traders and CIS Subcontractors: Our once and done package covers you from start to finish and includes ongoing support throughout the year.

CIS Contractor Registration and Returns

If you employ the services of subcontractors, we can register you as a CIS contractor. You must do so to allow you to deduct your subcontractor’s tax and complete your monthly HMRC CIS300 submissions.

Late Penalty Appeals

Since 2011 late filing penalty charges are £10 per day. We have a 99% success rate in getting these charges refunded.

Backdated and long overdue returns

We are able to complete all tax returns regardless of how late they are, although any rebates you are owed will only be paid on the tax returns for the last 4 years, in most cases.

Amendments to your previous returns

If you feel that your previous tax returns were not completed accurately, we can propose amendments to your last four tax returns. This may also increase your rebate or decrease your tax bill.

Recovering Lost Records such as payslips and CIS deduction statements

We can appeal to the tax office to get as much information released as possible, whilst at the same time liaising with your past contractors to recover as much info as possible.

Accounting Software

NJB Taxback Ltd has partnered with Quickbooks are our team members are certified ProAdvisors. Thanks to our partnership, we can offer massive discounts on various QuickBooks licenses, and we can advise which one is most suitable for your business.

Book-keeping

We can reconcile your QuickBooks transactions on either a monthly fixed cost rate or per transaction depending on which is most suitable for your business.

----------------------------------------------------------------- Get in touch

Our team of accountants and Book-keepers are here to help.

NJB TAXBACK offers a revolutionary one-stop solution to filing your self-assessment tax return that’s guaranteed against HMRC investigation.

Our service combines the expertise of our qualified, friendly team with our free App to supercharge the process of completing your end-of-year tax return.

- 14-Day average completion time

- Guaranteed against HMRC investigation

- Fees tailored to your requirement

A Simple Process

Get in touch

Download our free App and try our rebate calculator before signing up, or skip straight to signing up and book a call-back for a free consultation at your convenience.

Submit your information

We support bank statements, QuickBooks, emails or good old fashioned pen and paper. Whatever you prefer.

Sit back and relax

We aim to prepare all accounts for submission within 14 days. If you are due a refund, this will be paid directly into your bank account.

Our Services

Self-employed Startup

Includes Registering you as self-employed, applying for a UTR number, setting up a national insurance record, advising on a business bank account and optional accounting software.

Self-Assessment Tax Returns for Small Businesses

Sole Traders and CIS Subcontractors: Our once and done package covers you from start to finish and includes ongoing support throughout the year.

CIS Contractor Registration and Returns

If you employ the services of subcontractors, we can register you as a CIS contractor. You must do so to allow you to deduct your subcontractor’s tax and complete your monthly HMRC CIS300 submissions.

Late Penalty Appeals

Since 2011 late filing penalty charges are £10 per day. We have a 99% success rate in getting these charges refunded.

Backdated and long overdue returns

We are able to complete all tax returns regardless of how late they are, although any rebates you are owed will only be paid on the tax returns for the last 4 years, in most cases.

Amendments to your previous returns

If you feel that your previous tax returns were not completed accurately, we can propose amendments to your last four tax returns. This may also increase your rebate or decrease your tax bill.

Recovering Lost Records such as payslips and CIS deduction statements

We can appeal to the tax office to get as much information released as possible, whilst at the same time liaising with your past contractors to recover as much info as possible.

Accounting Software

NJB Taxback Ltd has partnered with Quickbooks are our team members are certified ProAdvisors. Thanks to our partnership, we can offer massive discounts on various QuickBooks licenses, and we can advise which one is most suitable for your business.

Book-keeping

We can reconcile your QuickBooks transactions on either a monthly fixed cost rate or per transaction depending on which is most suitable for your business.

Our team of accountants and Book-keepers are here to help.

Scotland

Scotland UK

UK Ireland

Ireland London

London